Mastering the Art of Cloud Accounting with FreshBooks

Introduction to Cloud Accounting

Cloud accounting refers to the practice of using online software or applications to manage and process financial transactions and data. Gone are the days of traditional desktop-based accounting systems, as businesses now have the opportunity to take advantage of the convenience and flexibility offered by cloud accounting.

With cloud accounting, all your financial records and information are stored securely in the cloud, rather than on a physical computer or server. This means you can access your financial data anytime, anywhere with an internet connection. As long as you have a device that can connect to the internet, such as a laptop, tablet, or smartphone, you can easily access and manage your accounting tasks.

One of the key benefits of cloud accounting is its ability to streamline and automate various aspects of bookkeeping and financial management. Tasks such as invoicing, expense tracking, reconciling bank statements, and generating financial reports can be done more efficiently with automation features provided by cloud accounting software.

Another advantage is that cloud accounting offers real-time collaboration capabilities. This means multiple users can work simultaneously on the same accounting data. For example, your bookkeeper can update transactions while you review reports at the same time. This eliminates delays in communication and allows for better teamwork between different stakeholders involved in your business's finances.

Cloud accounting also provides enhanced security measures compared to traditional methods. Leading cloud accounting platforms implement robust encryption protocols, secure servers, and regular backups to ensure that your financial data is safe from unauthorized access or loss due to hardware failures.

Additionally, cloud accounting offers scalability for businesses of all sizes. Whether you're a freelancer or a large corporation, cloud-based solutions allow you to customize your accounting system according to your specific needs. You can choose different plans or subscription levels depending on the features and functionalities required by your business.

Overall, adopting cloud accounting has become increasingly popular among businesses due to its numerous advantages. It simplifies financial management tasks while offering mobility, collaboration capabilities, improved security measures, and scalability. By embracing cloud accounting, businesses can optimize their financial processes and gain valuable insights into their financial performance, ultimately leading to more informed decision-making and increased efficiency.

In the next sections of this blog, we will explore how FreshBooks, a leading cloud accounting software, can help businesses harness the power of cloud accounting to simplify their bookkeeping tasks and transform their accounting processes.

Why Choose FreshBooks

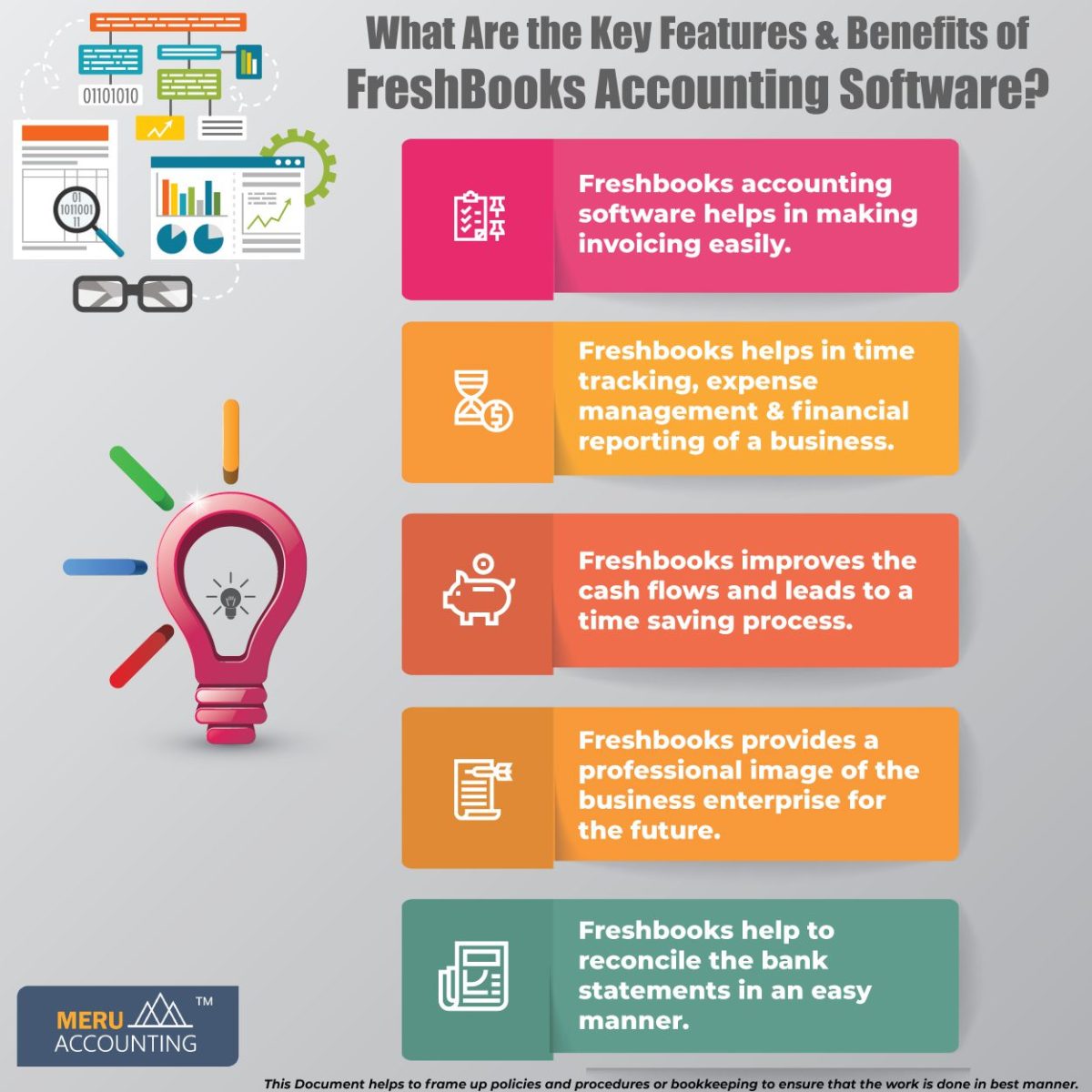

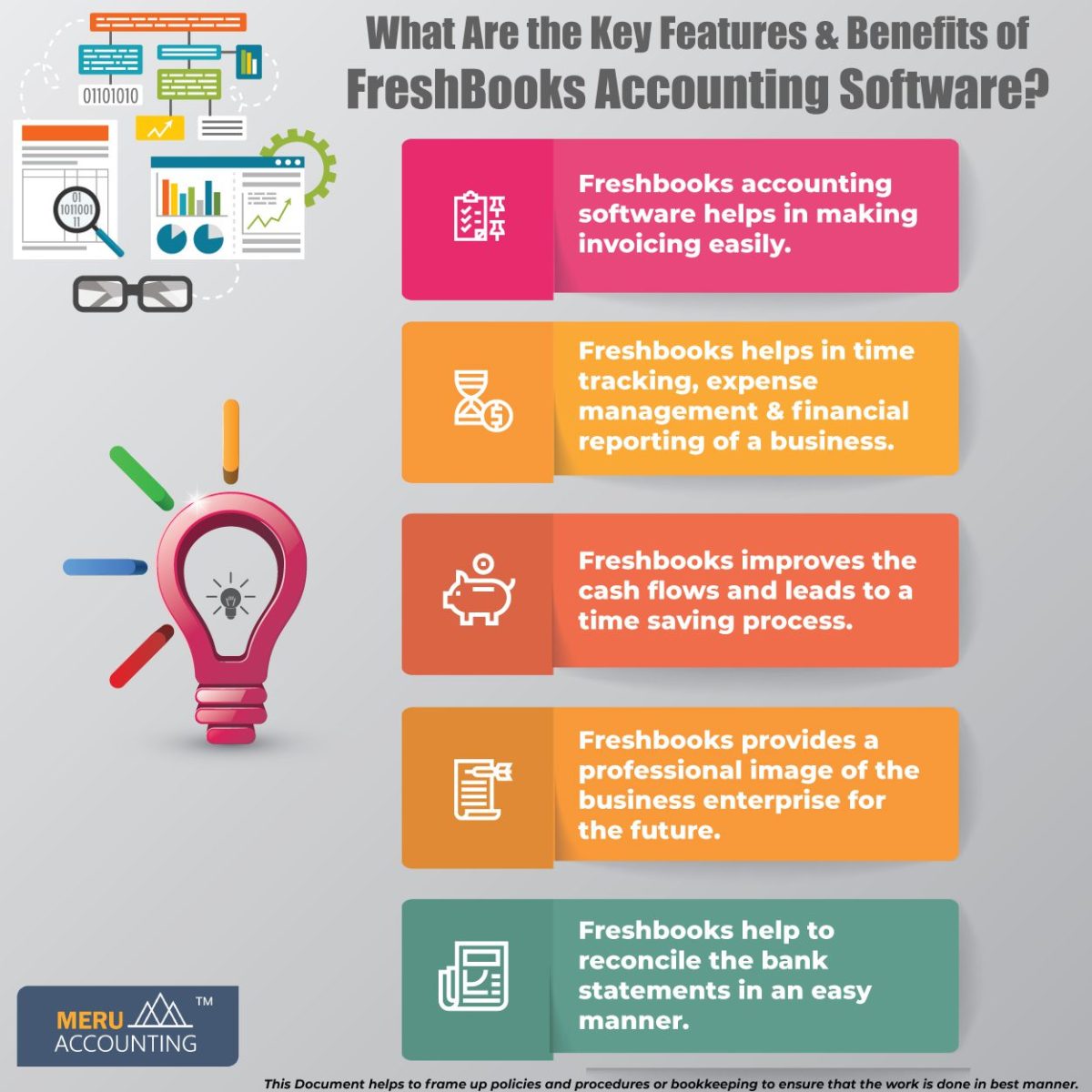

FreshBooks is a leading cloud accounting software that offers an array of features and benefits to businesses of all sizes. Here are some compelling reasons why you should choose FreshBooks for your accounting needs:

- User-Friendly Interface: FreshBooks has a user-friendly interface that makes it easy for beginners to navigate and use effectively. You don't need to be a finance expert or have extensive accounting knowledge to use the software. With its intuitive design, you can quickly learn how to navigate through the platform and access the features you need.

- Time-Saving Features: One of the primary advantages of using FreshBooks is its time-saving features. The software automates various manual tasks, such as invoicing, expense tracking, and generating financial reports. By automating these processes, FreshBooks allows you to spend less time on administrative tasks and more time focusing on growing your business.

- Professional Invoicing: With FreshBooks, you can create professional-looking invoices in no time. The software offers customizable templates that you can tailor to fit your brand image. Additionally, you can track outstanding invoices and send automatic reminders to clients for faster payment collection.

- Efficient Expense Tracking: Keeping track of expenses is crucial for any business's financial management. FreshBooks simplifies this process by allowing you to capture expenses using your mobile device's camera or by importing them directly from bank statements or credit card transactions. You can categorize expenses, attach receipts, and generate expense reports effortlessly.

- Streamlined Payment Collection: FreshBooks enables seamless online payment collection by integrating with popular payment gateways like Stripe and PayPal. This means clients can conveniently pay their invoices online with just a few clicks, improving cash flow for your business.

- Reliable Customer Support: If you encounter any issues or have questions about using FreshBooks, their customer support team is readily available to assist you via phone, email, or live chat. Their knowledgeable support representatives are there to help you navigate any hurdles you may face while using the software.

- Integrations and Add-Ons: FreshBooks offers a range of integrations and add-ons to enhance your accounting experience further. For instance, you can integrate FreshBooks with popular platforms like Shopify, Trello, and G Suite to streamline your workflow and access all your business tools in one place.

- Scalability for Business Growth: Whether you're a solo entrepreneur or a growing enterprise, FreshBooks offers scalable plans that can accommodate your business's needs. As your business expands, you can easily upgrade your plan to access additional features and capabilities.

In conclusion, FreshBooks is an excellent choice for businesses looking to streamline their accounting processes and harness the power of cloud accounting. With its user-friendly interface, time-saving features, professional invoicing capabilities, efficient expense tracking, reliable customer support, and scalability options, FreshBooks empowers businesses to simplify their financial management tasks and focus on what matters most - growing their business.

Setting Up Your FreshBooks Account

To get started with FreshBooks, setting up your account is a simple and straightforward process. Here are the steps to follow:

- Sign Up: Visit the FreshBooks website and click on the "Get Started" or "Sign Up" button. Fill in your email address, create a password, and provide some basic information about your business.

- Customize Your Account: After signing up, you can customize your FreshBooks account to match your business needs. Add your logo, company name, and other branding elements to give your account a personalized touch.

- Set Up Your Business Profile: Next, set up your business profile by providing essential details such as your business name, address, contact information, and tax identification number. This information will be used for generating accurate invoices and financial reports.

- Configure Your Payment Gateway: To enable online payments from your clients, you need to configure your preferred payment gateway within FreshBooks. It integrates seamlessly with leading payment processors such as Stripe and PayPal.

- Configure Taxes: Depending on the tax regulations in your country or region, FreshBooks allows you to configure sales tax rates for different jurisdictions easily. You can specify default tax settings that will be automatically applied to invoices and expenses.

- Connect Bank Accounts: For efficient expense tracking and reconciling transactions, you can connect your bank accounts directly to FreshBooks. By doing so, you can import bank transactions automatically into the software and categorize expenses effortlessly.

- Import Existing Data: If you have existing data from another accounting system or spreadsheets, FreshBooks provides options for importing this data into your new account. This includes client details, product or service lists, outstanding invoices, and more.

- Set Up User Roles and Permissions: If you have team members working with you or if you want to grant access to external accountants or bookkeepers, FreshBooks offers user roles and permissions management features. You can assign specific roles and control what information each user can access.

- Customize Email Templates: FreshBooks allows you to customize your email templates for various communications, such as invoice reminders, payment confirmations, and estimates. You can add your brand's voice and personalize the messages to maintain a consistent customer experience.

- Explore Additional Features: Once your account is set up, take some time to explore the additional features FreshBooks has to offer. From time tracking and project management to client portal access and expense categorization, these features can further streamline your accounting processes.

By following these steps, you can easily set up your FreshBooks account and start using the software to manage your finances effectively. With its intuitive interface and customizable options, FreshBooks provides a seamless experience for both experienced professionals and beginners in cloud accounting.

Importing and Organizing Your Data

When it comes to transitioning to a cloud accounting system like FreshBooks, one of the most important tasks is importing and organizing your data. This process allows you to migrate your existing financial information seamlessly into FreshBooks and ensures that all your records are accurately maintained in one centralized location. Here's how you can make this process smooth and efficient:

- Prepare Your Data: Before importing your data into FreshBooks, take some time to organize and clean up your information. Review your spreadsheets or data files to ensure that they are accurate, consistent, and formatted correctly for import. This preparation step will help avoid any discrepancies or errors later on.

- Choose a Data Import Method: FreshBooks offers multiple ways to import your data. You can use CSV files, Excel spreadsheets, or even use the built-in integration options if you're coming from another software platform. Take advantage of these options based on what works best for you.

- Import Your Clients: Start by importing your client list into FreshBooks. This includes their contact information, billing details, and any other relevant client data. By having all this information readily available within FreshBooks, it becomes easier to generate invoices and track payments efficiently.

- Import Your Products or Services: If you sell products or provide services, make sure to import your product or service catalog into FreshBooks next. This step ensures that you have accurate descriptions, pricing details, and inventory levels within the system, making it hassle-free when creating invoices for specific items.

- Import Your Invoices: If you have outstanding invoices from your previous system or manually created invoices in spreadsheets, you can import them directly into FreshBooks. This saves time and effort in re-creating invoices individually.

- Import Expenses: To maintain a comprehensive record of all expenses incurred by your business, import expense data from bank statements or spreadsheets into FreshBooks. Categorize them properly so that expense tracking becomes easier and more accurate.

- Reconcile Transactions: Once your data is imported, take some time to reconcile your imported transactions with the corresponding bank statements or source documents. FreshBooks offers a reconciliation feature that enables you to match transactions, ensuring your financial records are precise and up-to-date.

- Organize For Easy Retrieval: As you import data into FreshBooks, take advantage of the software's organizational features. Assign appropriate labels, tags, or categories to different types of data like expenses, invoices, or clients. This makes it easier to locate specific information quickly whenever needed.

By following these steps, you can seamlessly import and organize your data within FreshBooks. Doing so ensures that all your financial information is easily accessible and accurately recorded in one place. With this organized foundation, you can effectively manage your accounting tasks and gain valuable insights into the financial health of your business with ease.

Using FreshBooks for Invoicing and Expense Tracking

FreshBooks offers powerful features for invoicing and expense tracking, making it a valuable tool for businesses of all sizes. Whether you need to create professional invoices or efficiently manage your expenses, FreshBooks has got you covered.

With FreshBooks, creating and sending invoices is a breeze. The intuitive interface allows you to customize your invoice templates with your logo, colors, and branding. You can easily add line items for products or services, include any applicable taxes, and even set up recurring invoices for regular clients.

FreshBooks also offers automated late payment reminders, ensuring that you get paid on time. You can customize the frequency and content of these reminders to suit your needs. This feature helps you maintain a healthy cash flow by reducing the number of overdue payments.

Tracking expenses is equally effortless with FreshBooks. Simply upload receipts or import data from your bank statements to create expense entries. Categorize expenses into relevant categories like office supplies, travel expenses, or utilities for accurate record-keeping.

One standout feature of FreshBooks is its ability to capture expenses on-the-go through the mobile app. You can snap photos of receipts using your smartphone camera and upload them directly into FreshBooks. This eliminates the need to save physical receipts and ensures that all your expenses are recorded in real-time.

FreshBooks makes it easy to track billable hours as well. With their built-in time tracking feature, you can track how much time you spend on specific projects or tasks. This ensures accurate billing for clients who are billed based on hourly rates.

Regularly monitoring your income and expenses is crucial for business success, and FreshBooks simplifies this process by providing comprehensive reports. The reports feature provides insights into revenue trends, outstanding payments, expense breakdowns, and profitability analysis. These reports enable you to make informed financial decisions and identify areas where you can improve efficiency.

To further streamline your bookkeeping process, FreshBooks integrates seamlessly with bank accounts and payment gateways, allowing you to automatically import transactions. This integration eliminates the need for manual data entry, saving you time and reducing the risk of errors.

In addition to managing your own finances, FreshBooks also offers collaboration features that allow you to work with your team and clients. You can invite team members to access your FreshBooks account and assign them specific roles and permissions. This enables effective collaboration on projects and streamlines communication within your organization.

Overall, FreshBooks provides a user-friendly platform for invoicing and expense tracking. Its robust features, intuitive interface, and automation capabilities save you time and effort, allowing you to focus on growing your business. By utilizing FreshBooks for your invoicing and expense tracking needs, you can streamline your financial processes, improve cash flow, and gain valuable insights into the financial health of your business.

Streamlining Your Bookkeeping with FreshBooks Automation

Bookkeeping can be a daunting and time-consuming task for businesses of all sizes. However, with FreshBooks automation features, you can streamline your bookkeeping process and save valuable time and effort. FreshBooks offers a range of automation tools that simplify tasks like generating invoices, tracking expenses, and importing transactions. By leveraging these automation capabilities, you can focus on growing your business while FreshBooks takes care of your financial needs.

One of the key automation features offered by FreshBooks is automated invoicing. You no longer have to manually create and send invoices to your clients. With FreshBooks, you can set up recurring invoices for regular clients, saving you the hassle of creating new invoices every time. You can also customize invoice templates with your logo and branding, ensuring a professional look for your business. Furthermore, FreshBooks automatically sends late payment reminders to clients, ensuring prompt payment and improving cash flow.

Expense tracking is another area where FreshBooks automation shines. Instead of manually entering every expense into the system, you can effortlessly import data from bank statements or upload receipts directly into FreshBooks. This eliminates the need for manual data entry and reduces the risk of errors. The mobile app allows you to capture receipts on-the-go by simply taking a photo with your smartphone camera and uploading it directly into FreshBooks.

FreshBooks also automates the process of capturing billable hours. With their built-in time tracking feature, you can accurately track how much time you spend on specific projects or tasks. This ensures accurate billing for clients who are billed based on hourly rates.

By automating these repetitive tasks, FreshBooks not only saves you time but also improves accuracy and reduces human error in your bookkeeping process. With automation taking care of these administrative tasks, you can focus on more strategic aspects of running your business.

FreshBooks integration with bank accounts and payment gateways further streamlines your bookkeeping process. You can automatically import transactions from your bank accounts into FreshBooks, eliminating the need for manual data entry. This integration ensures that your financial records are always up to date, providing you with real-time insights into your business's financial health.

In conclusion, FreshBooks offers powerful automation features that streamline your bookkeeping process. With automated invoicing, expense tracking, and time tracking, you can save time and effort while improving accuracy in your financial management. The integration with bank accounts and payment gateways further simplifies the process by automatically importing transactions. By harnessing the power of automation, FreshBooks helps you focus on growing your business while ensuring efficient and accurate bookkeeping.

Collaborating with Your Team and Clients

Collaborating with your team and clients is essential for efficient and effective accounting processes. With FreshBooks, you can easily collaborate and share information with your team members and clients, promoting seamless communication and increased productivity.

FreshBooks offers a variety of collaboration features that make working together a breeze. You can invite team members to access your FreshBooks account, assigning specific roles and permissions to ensure the right level of access. This allows for efficient collaboration on tasks such as invoicing, expense tracking, and reporting. Team members can work simultaneously on different aspects of your accounting process, eliminating the need for back-and-forth email exchanges.

In addition to collaborating with your internal team, FreshBooks also provides tools for seamless communication with your clients. You can securely share financial data, invoices, and reports directly from within FreshBooks. Clients can access their own portal where they can view their invoices, pay online, and communicate any inquiries or issues. This simplifies the client experience and promotes transparency in your client relationships.

Another valuable collaboration feature offered by FreshBooks is the ability to assign tasks to team members or clients. You can create to-do lists, set due dates, and track progress on specific tasks or projects. This ensures accountability within your team and streamlines workflow management.

Furthermore, FreshBooks integrates with popular project management platforms like Trello and Asana. This allows you to sync project information between platforms, ensuring that all relevant data is up-to-date across systems. For example, if you're tracking billable hours in Trello or Asana, you can automatically import this data into FreshBooks for accurate billing.

FreshBooks also facilitates collaboration by providing an intuitive commenting system. Team members or clients can leave comments directly on invoices or expenses to provide context or ask questions. This eliminates the need for multiple email threads or phone calls to clarify details.

Lastly, FreshBooks offers customizable client proposals that you can create and send directly through the platform. You can collaborate with your team to create professional proposals that outline project details, scope of work, and pricing. Clients can review and accept proposals online, further streamlining the client onboarding process.

In conclusion, FreshBooks provides robust collaboration features that enhance communication and productivity within your team and foster better relationships with your clients. By inviting team members and clients to collaborate on specific tasks, securely sharing financial data, assigning tasks, integrating with project management tools, and utilizing commenting systems and customizable proposals, FreshBooks simplifies the collaborative accounting process. With FreshBooks' collaboration tools, you can streamline workflows, improve transparency, and ensure that everyone is aligned towards achieving your accounting goals.

Generating Reports and Insights with FreshBooks

FreshBooks provides powerful reporting and analytical tools that give you valuable insights into your business finances. With a few clicks, you can generate comprehensive reports to understand your income, expenses, profitability, and more.

One of the key features of FreshBooks is its customizable reporting options. Whether you need a broad overview or detailed breakdowns, FreshBooks allows you to tailor the reports to meet your specific needs. From profit and loss statements to balance sheets, you can easily access a range of standard reports that provide a snapshot of your financial health.

FreshBooks also offers advanced reporting capabilities for deeper analysis. You can create custom reports based on specific criteria such as clients, projects, or time periods. This allows you to track important metrics like client profitability, project performance, or revenue streams. By understanding these key indicators, you can make data-driven decisions that drive growth and profitability.

Another valuable feature is the ability to save and schedule reports in FreshBooks. You can set up automatic report generation at regular intervals or on specific dates. This ensures that you always have the most up-to-date information at your fingertips without needing manual intervention each time you need a report.

In addition to financial reports, FreshBooks offers insights into individual client activities through invoice tracking. You can see when invoices are viewed and paid by clients. This real-time visibility helps you stay on top of outstanding payments and ensure timely follow-ups with clients who may have missed payment deadlines.

With FreshBooks' mobile app, you can access your reports anytime and anywhere from your smartphone or tablet. This flexibility allows you to stay informed even while on the go and make informed decisions no matter where you are.

Furthermore, FreshBooks integrates with popular third-party software such as QuickBooks and Slack among others,. This means that all your financial data is seamlessly consolidated in one place for easy analysis and reporting.

Overall, generating reports and gaining insights with FreshBooks empowers you to take control of your financials. You can easily track your progress, identify trends, and make informed decisions to drive success in your business. With customizable reports, scheduling options, invoice tracking, mobile accessibility, and integrations with other software tools, FreshBooks provides a comprehensive reporting solution that takes your cloud accounting experience to the next level.

Ensuring Security and Data Privacy in Cloud Accounting

When it comes to cloud accounting, one of the top concerns for businesses is security and data privacy. With FreshBooks, you can rest assured knowing that your sensitive financial information is protected by robust security measures.

FreshBooks prioritizes the security and confidentiality of your data. They employ industry-standard encryption technology to safeguard your financial information both during transmission and storage. This ensures that only authorized individuals have access to your data, providing an extra layer of protection against potential threats.

In addition to encryption, FreshBooks also utilizes secure data centers that are equipped with state-of-the-art physical security measures. These include restricted access controls, surveillance systems, and firewalls that prevent unauthorized access or intrusion. By housing your data in these highly secure facilities, FreshBooks ensures that your information remains safe from physical threats as well.

To further protect against potential risks, FreshBooks implements regular security audits and vulnerability assessments. This allows them to identify any vulnerabilities or weaknesses in their systems and promptly address them before they can be exploited. By staying vigilant and proactive in their security practices, FreshBooks consistently maintains a high level of protection for your data.

Furthermore, FreshBooks adheres strictly to industry regulations and best practices for data privacy. They are certified under various protocols such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). These certifications demonstrate their commitment to maintaining compliance with global standards for data protection.

FreshBooks also offers multiple layers of user access controls to ensure that only authorized individuals within your organization can view or modify sensitive financial information. This helps prevent unauthorized users from accessing confidential data, adding an additional level of protection to your accounts.

As a cloud-based solution, FreshBooks takes care of regular backups so you don't have to worry about losing any important financial data. Your information is automatically saved and stored securely in the cloud, allowing you peace of mind knowing that even if there is a hardware failure or other unforeseen event, your data is safe and easily recoverable.

In conclusion, security and data privacy are of utmost importance when it comes to cloud accounting. FreshBooks takes this responsibility seriously by implementing robust security measures, strict compliance with industry regulations, and regular audits. With their commitment to protecting your financial information, you can confidently rely on FreshBooks for secure and private cloud accounting.

Conclusion: Transform Your Accounting with FreshBooks

FreshBooks is a game-changer for businesses seeking to master the art of cloud accounting. With its user-friendly interface, robust features, and commitment to security and data privacy, FreshBooks empowers organizations to streamline their accounting processes and focus on what they do best.

By harnessing the power of FreshBooks, businesses can transform their accounting operations into a smooth and efficient workflow. From setting up your FreshBooks account to importing and organizing your data, FreshBooks simplifies every step of the process. Its intuitive design allows users to easily navigate through the platform and access the tools they need with just a few clicks.

One of the standout features of FreshBooks is its powerful invoicing and expense tracking capabilities. With customizable templates and automated reminders, sending professional-looking invoices becomes a breeze. Tracking expenses is equally effortless, as FreshBooks syncs with bank accounts and credit cards, automatically categorizing transactions for easy record-keeping.

To further streamline bookkeeping tasks, FreshBooks offers automation features that save time and minimize errors. From recurring invoices to expense importing, these automation tools eliminate repetitive tasks, allowing businesses to focus on more important matters.

Collaboration is made simple with FreshBooks' team and client management features. Users can invite team members or clients to collaborate on projects, share files securely through the platform, and track project progress in real-time. This fosters effective communication and ensures everyone stays on the same page.

Generating reports and gaining valuable insights is another area where FreshBooks shines. Users can generate comprehensive financial reports at the click of a button, giving them a clear picture of their business's financial health. These insights allow for informed decision-making and help identify areas for improvement or growth.

When it comes to security and data privacy, FreshBooks sets industry standards. With advanced encryption technology during transmission and storage of data, along with secure data centers equipped with physical security measures, FreshBooks prioritizes safeguarding sensitive financial information. Regular security audits and adherence to industry regulations further enhance data protection.

In conclusion, FreshBooks is the ultimate tool for transforming your accounting processes. Its user-friendly interface, powerful features, and robust security measures make it an ideal choice for businesses of all sizes. From streamlined invoicing and expense tracking to automation and collaboration tools, FreshBooks revolutionizes the way businesses manage their finances. With FreshBooks, you can confidently embrace cloud accounting and focus on growing your business with peace of mind knowing your financial data is in safe hands.